...SmartAsset...

Are you aware that you could boost your retirement outlook by using this new startup's free service? Founded by Princeton grad Michael Carvin, the internet’s most-used financial technology website just raised $28 million in Series C funding to help you make it easier to plan your retirement.

New York, New York: With over 110 million Americans over age 50, it's no wonder this Princeton grad's startup just raised another $28 million in funding to help people conquer retirement.

For a long time, there was no easy way to compare financial advisors from all of the huge firms out there. You had to check one site, then jump to another and enter all of your information all over again. You’d be stuck doing all the work just to try to find someone who would understand your goals and work in your best interests.

Now, all that is changing. Thanks to SmartAsset, the FinTech startup that’s now raised over $51 million in total funding, the information you need to help you tackle your retirement can be found in one place. SmartAsset will use the new resources from their Series C round to continue expanding its financial advisor matching platform, which links everyday investors like you to the first advisor comparison marketplace of its kind. Featured on Y Combinator’s Top 100 Companies list, it’s clear that SmartAsset has attracted the attention of both funding partners like Focus Financial Partners, who led their Series C funding, and soon-to-be retirees who are looking to plan for a comfortable retirement.

As seen on...

So what exactly do you need to do to set yourself up for a comfortable retirement? There’s one easy rule to follow.

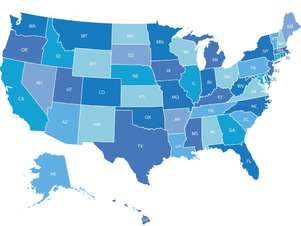

It’s crucial to compare financial advisors. Don’t even consider working with the first person you meet without doing this first. A shocking percentage Americans are unprepared for retirement or are unhappy with their current financial advisors. A Voya Financial report found that 79% of people who do use a financial advisor “know how to pursue achieving their retirement goals.” And with free services like SmartAsset, comparing advisors today so that you aren’t accidentally costing yourself a happy retirement later is a breeze. SmartAsset works with a robust network of financial advisors all across the U.S., and CEO Michael Carvin says he expects that number to grow into the tens of thousands soon.

Americans don’t always realize how much they need for retirement. If you haven't spoken to a financial professional lately, you might not be as prepared as you thought. Fortunately, hundreds of thousands of smart investors and retirees have used SmartAsset’s free service to find the right financial advisors for them. It’s no wonder that with so many Americans finding the right financial advisors, SmartAsset has been able to raise another $28 million in capital. SmartAsset is free and easy to use, and has won multiple Webby Awards for Best User Experience. Just imagine yourself enjoying your dream retirement!

Follow these steps to jumpstart your retirement plan:

Simply enter your ZIP code below.

Once you enter your ZIP code and fill out your preferences, you can compare fiduciary financial advisors local to you.

Start planning for that dream retirement!

On site please enter your zip code.

No comments:

Post a Comment